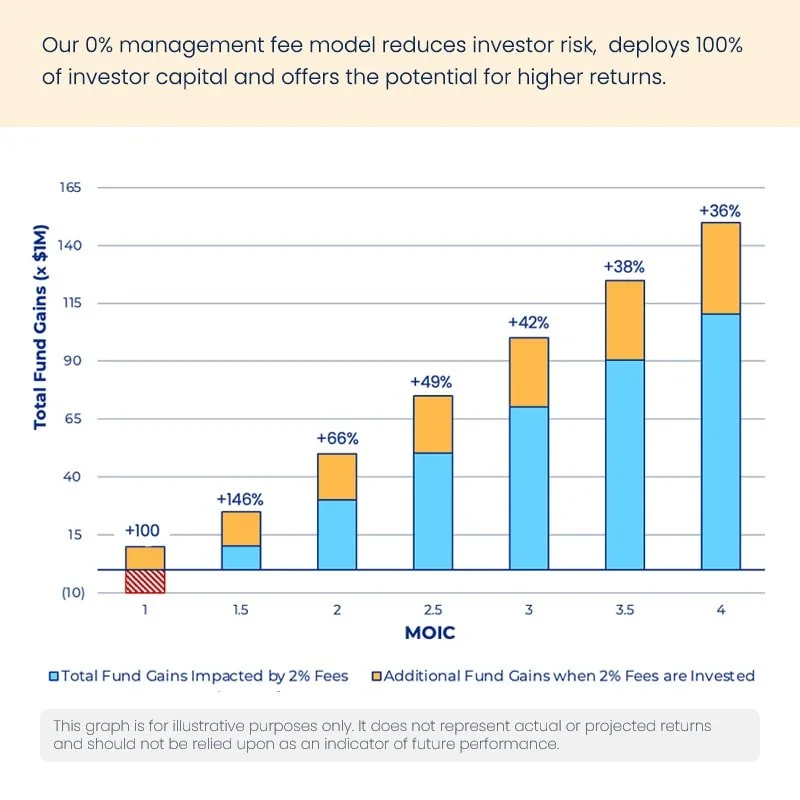

Pioneering an aligned investment model with 0% management fees.

Aligned Incentives • Smarter Capital Deployment • Better Returns

We do not make money unless you make money. Period.

Better alignment,

better returns.

At Viking Maccabee, we've developed a better, zero-management fee fund model. This innovative approach directly aligns our incentives with those of our investors, allowing us to prioritize value creation over growing assets under management (AUM). By deploying 100% of investor capital, we maximize capital efficiency and are incentivized to make smarter, more strategic investments. Simply put, we succeed when our investors succeed.

How we invest

Founded in 2018, we are engaged investors willing to roll up our sleeves to support our portfolio companies. We invest in exceptional teams with transformative visions and the ability to execute.

US-Focused

Our primary focus is innovative startups across the United States. But we have leveraged our powerful network to identify and seize exceptional international opportunities.

Tech-First,

Sector Agnostic

We are generalist investors looking for transformative technologies, with a focus on AI-enabled services, health-tech, and fin-tech markets.

Stage Agnostic

We are opportunistic, backing exceptional teams at all stages of their journey. We target early-stage startups with an average check size of $250k while maintaining flexibility to allocate more for follow-ons and later-stage deals.

Our network is our edge

Our team has cultivated global relationships with top-tier investors, founders, and industry leaders. This access enables us to cut through the clutter and source exclusive, high-quality deals not available to most private investment groups of our size.

As investors, we actively help create value, whether it's by connecting our visionary entrepreneurs with potential customers or helping our portfolio companies raise their next round.

TESTIMONIALS